Neuste Beiträge

Crowdlending Trends 2025

Die Kreditbranche erlebt seit einigen Jahren eine tiefgreifende Transformation. Während Banken lange Zeit

Die Zukunft des Crowdlendings: Trends und Entwicklungen

Crowdlending hat sich in den letzten Jahren zu einer etablierten Finanzierungsalternative entwickelt

Mietvorfinanzierungen - Rental Deals

Die Welt der Finanzierung entwickelt sich ständig weiter, und mit ihr entstehen neue Konzepte, die sowohl

KMUs und Startups – Wie erstelle ich einen tragfähigen Businessplan?

Aufgrund eine Fachbeitrags unseres Gründers Roger Bossard nehmen wir dieses Mal ein etwas spezielleres

KMU-Kredit: Die wichtigsten Faktoren, die bei der Auswahl zu beachten sind

Bei der Auswahl eines Kredits für kleine und mittlere Unternehmen (KMU) gibt es viele wichtige Faktoren

Erkundung des wachsenden Trends bei Ratenzahlungslösungen in der Schweiz

In der Schweiz verändert sich die Einzelhandelslandschaft, da sich Verbraucher zunehmend für

E-Bike auf Ratenzahlung: Alles, was Sie wissen müssen

Sie möchten ein E-Bike kaufen, aber der hohe Preis schreckt Sie ab? Keine Sorge, denn in der Schweiz gibt

Die Macht des passiven Einkommens in der Schweiz: Ihr ultimativer Leitfaden

Willkommen zum ultimativen Leitfaden für die Erschließung des passiven Einkommens in der Schweiz!

Autokäufe einfach machen: Private Ratenzahlung ohne Bank in der Schweiz

Der Kauf eines Autos kann eine komplizierte Angelegenheit sein, besonders wenn man die hohen Kosten bedenkt.

Erfolg freisetzen: Wie Crowdfunding die Schweizer Startup-Landschaft verändert

Innovation kennt im florierenden Startup-Ökosystem der Schweiz keine Grenzen und Crowdfunding spielt eine

Sparen Sie Geld mit unseren preiswerten Darlehen in der Schweiz

Willkommen bei Crowd4Cash - Ihrem vertrauenswürdigen Partner für preisgünstige Darlehen in der

Für mehr Flexibilität: Der Sekundärmarkt von Crowd4Cash

In unserem ständigen Bestreben, unsere Crowdlending Plattform optimal zu gestalten, freuen wir uns Ihnen

Der Einfluss der Kreditwürdigkeit auf Ihren Finanzstatus in der Schweiz

Die Kreditwürdigkeit spielt eine entscheidende Rolle für Ihre finanzielle Lage in der Schweiz. In

Wie einen Kredit beantragen? Leitfaden für den optimalen Ablauf

Möchten Sie einen Kredit beantragen, wissen aber nicht, wie Sie vorgehen sollen? Keine Sorge, wir haben

Marketplace Lending Report Switzerland 2023

Eine neue Ausgabe des "Marketplace Lending Reports Switzerland" für das Jahr 2023 wurde

Erhöhung der Zinssätze in Sicht – Guter Moment für einen Kredit?

Die Finanzwelt ist einem stetigen Wandel unterworfen und das letzte Jahr bildete hier keine Ausnahme. Mit

Entwicklung von Private Equity Investitionen in 2023

Seca und Startupticker.ch haben eine weitere Version des „Swiss Venture Capital Report 2023“

Wie wählt man seine Kreditausfallversicherung aus?

Eine Kreditausfallversicherung ist von unschätzbarem Wert und spielt eine entscheidende Rolle bei der

IFZ FinTech Study 2023 zeigt weiteres Wachstum für Fintechs

Crowd4Cash ist seit Jahren Teil der IFZ FinTech Studie 2023 und ergreifen die Gelegenheit Ihnen aus erster

Weiteres rasches Wachstum beim Crowdlending

Letztes Jahr entgingen Schweizer Banken rund 18.5 Milliarden Franken an Kreditvolumen. Die Konkurrenz durch

7 Spartipps – Wie man ein Vermögen aufbauen kann

Das Thema «Geld» ist in der Schweiz ein Tabu Thema, trotzdem betrifft es uns alle. In diesem

Crowdlending, ein ideales Mittel für kleine Unternehmen

Kleine Schweizer Unternehmen nehmen oft keinen Bankkredit auf, aufgrund von hohen Zinsen und mühsamen

Ausblick für Crowdfunding bei Crowd4Cash

Im kürzlich publizierten Crowdfunding Monitor 2022 der HSLU wird ein weiteres Wachstum fürs

Crowdlending, ein Investment in die Schweizer KMU-Wirtschaft

Investitionen ins Crowdlending bei Crowd4Cash kommen im Vergleich zu anderen Investments überproportional

Private Equity, Private Debt und Direct Lending

Private Equity, Private Debt und Direct Lending werden oft im selben Kontext verwendet. Doch was ist mit jedem

Crowd4Cash Easy Ratenzahlung - Kundenstimmen

Mittlerweile vertrauen über 80 Geschäfte dem Point of Sales (PoS) Ratenzahlungsangebot von

Spannende Alternativen zur klassischen KMU Finanzierung

Die vergangenen 14 Monate haben die Wirtschaft und das bisherige Verständnis von Sicherheit in Ihren

Stolpersteine bei privaten Darlehen – Tipps und Tricks

Private Darlehen sind weit verbreitet, gerade unter Freunden und in der Familie. Dabei sind Sie eine einfache

Kreditkarten – Einblick und Kostenrechner bei Teilzahlung

Kreditkarten - Jeder kennt und schätzt sie. Keine Hotelbuchung im Ausland ohne Kreditkarte: Einkaufen im

Crowd4Cash am Zuger Jungunternehmerpreis 2020

Eine etwas andere Erfahrung. Wir durften als einer von acht im Vorfeld ausgesuchten Finalisten am

Wieso sich die Refinanzierung eines Darlehens lohnt - 2 Beispiele

Crowd4Cash legt hohen Wert auf die Kundenzufriedenheit. Darum freut es uns umso mehr, dass wir in den letzten

Crowd4Cash Easy – Ratenzahlung anbieten als Händler

Nach einer längeren Testphase wurde Crowd4Cash Easy Mitte2019 lanciert. Die seither erfahrene Resonanz

Marktentwicklung Crowdfunding Schweiz 2019

Basierend auf dem Crowdfunding Monitor 2020 der Hochschule Luzern möchten wir Ihnen die wichtigsten

Wie mildern Corona-betroffene KMU die wirtschaftlichen Folgen ab?

Aus aktuellem Anlass befassen wir uns mit dem Thema Coronavirus. Viele KMUs werden durch die nationalen und

Private Equity in der Schweiz – Swiss Venture Capital Report 2020

Wie immer erscheint zu Beginn des Jahres der Swiss Venture Capital Report, welcher die Finanzierungen im

Das Crowd4Cash Team stellt sich vor: Unser CFO und Gründer Roger Bossard

Das Crowd4Cash Team stellt sich vor: Unser CFO Roger Bossard

Das Crowd4Cash Team stellt sich vor: Unser CEO Andreas Oehninger

Das Crowd4Cash Team stellt sich vor: Unser CEO Andreas Oehninger

Vergleich Bankkredit – Crowdlending beim KMU-Kredit

Was sind eigentlich die Vorteile und Nachteile eines Crowdlending-Kredites gegenüber einem KMU

Rechtliche Situation von P2P Krediten in der Schweiz

Im Rahmen der KMU Serie behandeln wir heute in der vierten Folge die rechtliche Einordnung von P2P Krediten in

Firmenkredite in der Schweiz im internationalen Vergleich

Im Rahmen der mehrteiligen KMU Serie, möchten wir nun im dritten Teil einen Einblick in die Welt der

Wichtigste Gründe für KMUs auf Fremdfinanzierung zu verzichten

Als Verantwortlicher eines KMU stellt man sich immer wieder die Frage, wie kann ich das Unternehmen optimal

KMU Finanzierung in der Schweiz -Daten und Fakten

Im Rahmen seines Fachreferates an einem Finanzkongress konnte Crowd4Cash CFO Roger Bossard sein breites

Das Crowd4Cash Team stellt sich vor: Robert Bareder

Das Crowd4Cash Team stellt sich vor: Robert Bareder

Das Crowd4Cash Team stellt sich vor: Jugoslav Arsovski (CTO)

Das Crowd4Cash Team stellt sich vor: Jugoslav Arsovski (CTO)

Wieso ist Portfolio-Diversifikation beim Crowdlending wichtig?

Wieso ist Diversifikation beim Crowdlending wie bei allen anderen Investitionen wichtig? In unserem Blog

Das Crowd4Cash Team stellt sich vor: Frank Meierhofer

Das Crowd4Cash Team stellt sich vor: Frank Meierhofer

Crowd4Cash Easy - Digitale Finanzierungslösung für KMU’s

Eine der grössten Herausforderungen eines jeden KMU ist die Sicherstellung der eigenen Liquidität.

Interview mit dem Crowd4Cash Gründer

Crowd4Cash hat mit über 200 finanzierten Krediten einen weiteren wichtigen Meilenstein erreicht.

Entwicklung des Schweizer Crowdlending Marktes in 2018/2019

Basierend auf dem Crowdlending Survey 2019 der Hochschule Luzern möchten wir Ihnen die wichtigsten

Finanzielle KPI der Crowd4Cash Plattform 2017-2019

Seit rund zwei Jahren vermitteln wir über unserer Crowdlending-Plattform Crowd4Cash Privat- und

Wie funktioniert der neue Schweizer Kurzkredit von Crowd4Cash?

Was ist der Kurzkredit und wie funktioniert er. Wir erklären Ihnen die Funktionsweise und geben etwas

Wie finanziert sich die Schweiz - Wie wird das Geld verwendet?

Für uns als alternativen Kreditanbieter im Privatkredit-Bereich natürlich besonders spannend sind

Was sind Ratenversicherungen und was bringen Sie im Crowdlending?

Die Ratenversicherung stellt ein sehr wichtiges Element für die Kreditnehmer und Kreditgeber im

Wie fülle ich als Kreditnehmer die Steuererklärung korrekt aus?

Kreditnehmer sparen bei Crowd4Cash bares Geld da sie im Vergleich zu traditionellen Kreditinstituten und

Crowdlending mit anderen Anlageklassen - eine Renditevergleich

Wir haben die Rendite eines realen Crowdlending Portfolios bei Crowd4Cash verglichen mit der Entwicklung an

Bundesrat setzt zum Sprung für die P2P-Crowdlending-Akteure an

Der Bundesrat hat durch den Entscheid vom 30.November 2018 dem Schweizerischen Finanzplatz die Tür zu

Wieso einen KMU-Kredit über Crowdlending aufnehmen?

Kleinere und mittlere Unternehmen (KMU) sind der zentrale Pfeiler der Schweizer Wirtschaft. In der Schweiz

Auswirkungen steigender Zinsen auf ein Crowdlending-Portfolio

Wir wurden in der Vergangenheit wiederholt von unseren Kunden gefragt, welchen Einfluss eine allfällige

Gute Gründe einen Kredit abzulösen

Wir beleuchten alle relevanten Aspekte einer Umschuldung in einem Artikel. Von den rechtlichen Grundlagen,

Ein umfassender Vergleich zwischen Autokredit und Leasing

Das Crowd4Cash hat für Sie die wichtigsten Punkte rund um das Leasing und den Autokauf mit Kredit

Vorteile eines Privatkredites bei Crowd4Cash

In diesem Blog erläutern wie die Vorteile eines Privatkredites bei Crowd4Cash. Zudem klären wir die

Wieso sind Crowdlending für Institutionelle Investoren spannend?

Crowdlending Investitionen, also Anlagen in ein diversifiziertes Konsum- und KMU Kreditportfolio sind eine

Spannende Einblicke mit dem Schweizer Crowdlending Survey 2018

Der neue Crowdlending Survey 2018 wurde erstmals durch die Hochschule Luzern mit der Beratungsgesellschaft PwC

Beispiel einer erfolgreichen Umschuldung bei Crowd4Cash

in Schicksal, das die meisten unvermittelt treffen kann: Der Kreditnehmer tappt nach der Scheidung in die

Peer-to-Peer Kredite in China – Eine Erfolgsgeschichte?

Im Rahmen des China-Swiss Fintech Forums in Zürich hatte Crowd4Cash die Gelegenheit, den

Crowd4Cash akzeptiert Investitionen mit Cryptocurrencies

Crowd4Cash ermöglicht erstmals in der Schweiz renditestarke Direkt-Investitionen mit Cryptocurrencies in

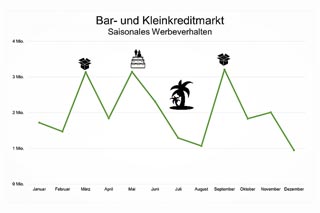

Der Privatkredit – ein saisonales Produkt?

Gemäss einer Umfrage von Comparis hat jeder dritte Erwachsene in der Schweiz hat schon einmal einen

Einblick ins Anlageverhalten der Schweizer

Wir möchten heute die Erkenntnisse einer interessante Studie von Blackrock, dem weltweit grössten

Neue Wege in der Start-up Finanzierung in der Schweiz

Das Crowd4Cash Team hatte diese Woche das Vergnügen und die Ehre persönlich einer Rede von Bundesrat

Finanzierung der KMU – Crowdlending als Alternative?

Kleine und mittlere Unternehmen (KMU) sind in der Schweiz traditionell stark in der Bevölkerung

Der Vergleich von Crowdlending Schweiz und Europa

Crowdlending ein attraktives aber exotisches Nischenprodukt? In der Schweiz mag Crowdlending oder Peer-2-Peer

Crowdlending Vergleich mit einem Bankkredit?

Crowdlending als Konkurrenz zu den Banken? Was unterscheidet die beiden Modelle voneinander und wird

Ein Kredit übers Internet: Was ist Crowdlending?

Crowdlending auch Peer-to-Peer lending genannt ist eine relativ neue Form des Kreditgeschäftes.

Der Crowdlending Branche wird das Leben leichter gemacht

Am 5. Juli 2017 hat der Bundesrat eine Änderung der Bankenverordnung beschlossen. Uns Crowdlending

Was ist Crowdlending, -supporting, -investing und -donation?

Vor einiger Zeit haben wir über das Peer-to-Peer Crowdlending Modell berichtet. Doch es gibt noch weitere