Wieso ist Diversifikation beim Crowdlending wie bei allen anderen Investitionen wichtig? In unserem Blog zeigen wir Ihnen auf, wieso sich ein diversifiziertes Portfolio beim Crowdlending auszahlt und worauf zu achten ist.

Wie bei allen Investitionen gilt auch beim Crowdlending: Nicht alle Eier in den gleichen Korb legen. Wie Sie idealerweise in verschiedene Assetklassen d.h. Aktien, Obligationen etc. investieren, gilt es auch beim Crowdlending das Portfolio möglichst breit zu diversifizieren.

Kreditausfälle können auch bei sehr vorsichtiger Risikoselektion nicht ganz verhindert werden. Sei es durch unvorhersehbare Schicksalsschläge oder andere Umstände seitens des Kreditnehmers, die Zahlungsfähigkeit kann sich während der Laufzeit positiv oder negativ verändern. Daher gilt es als Investor darauf zu achten, dass in ein möglichst breit diversifiziertes Portfolio angelegt wird.

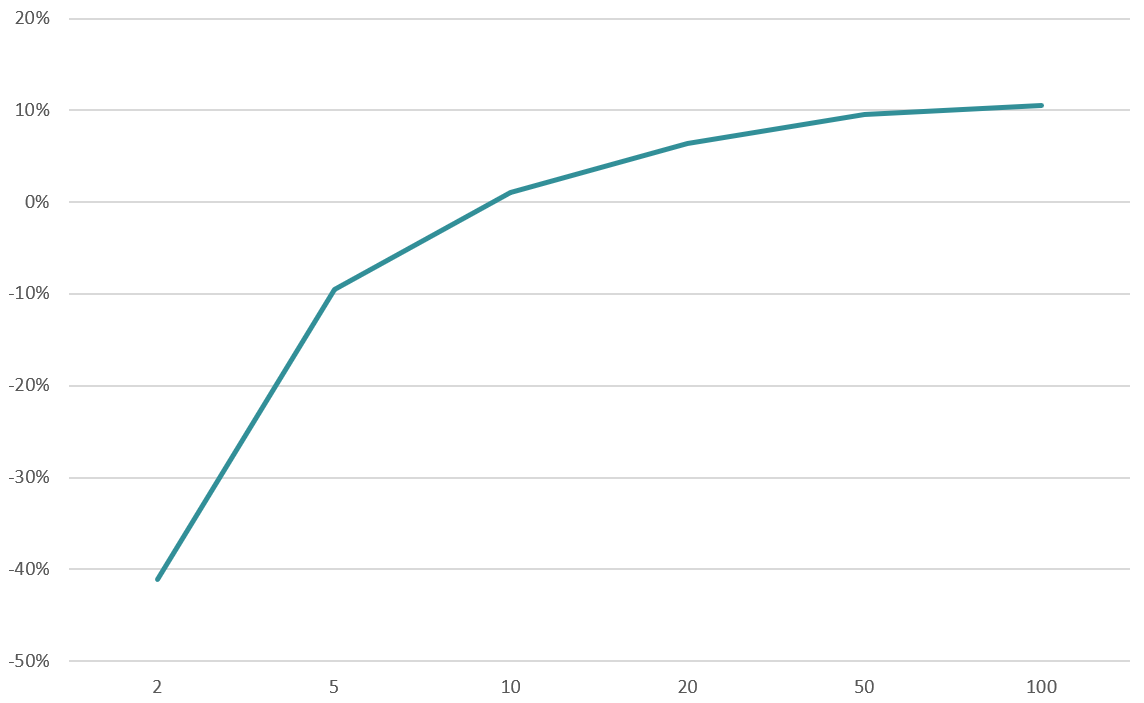

Anhand eines Modellbeispiels zeigen wir Ihnen auf, wie sich Ausfälle bei unterschiedlicher Diversifikation auf die Gesamtrendite niederschlagen. Dazu haben wir simuliert, wie sich zwei Kreditausfälle in der Mitte der Laufzeit auf ein Portfolio von 2, 5, 10, 20, 50 und 100 Krediten auf die Gesamtperformance auswirken.

Folgende Annahmen liegen dem Modell zugrunde:

Rendite bei zwei Ausfällen in der Mitte der Laufzeit bei einem Portfolio von

• 48 Monaten Durchschnittslaufzeit

• 5.5% Durchschnittlicher Nettozins

• Immer gleicher Investitionsbetrag

• Keine Reinvestitionen

bei der entsprechenden Anzahl Projekte (2,5,10,20,50 oder 100)

Bereits ab 10 Projekten ergibt sich trotz der Ausfälle eine positive Rendite, bei 100 ergibt sich bereits eine Netto-Rendite von 11% (ohne Reinvestitionen). Unter Berücksichtigung der monatlichen Rückflüsse eine attraktive Risikorendite im Nullzinsumfeld. Um die Rendite weiter zu steigern, empfehlen wir eine Reinvestition der Rückzahlungen, was zusätzlich zur Portfolio Diversifikation beiträgt.

Diversifizieren des Portfolios geht komfortabel mit dem Crowd4Cash Autoinvestor, bei welchem die Investoren eine entsprechende Allokation automatisiert erreichen können. Mehr zum Autoinvestor finden Sie hier.