Die Finanzwelt ist einem stetigen Wandel unterworfen und das letzte Jahr bildete hier keine Ausnahme. Mit Zinserhöhungen aufgrund der herrschenden Inflation wurden die Märkte besonders herausgefordert. Auch die Kredite sind diesen Änderungen in der Finanzwelt ausgesetzt und verändern die Konditionen für die Konsumenten. In diesem Blogpost werfen wir einen genauen Blick auf die zu erwartende Konsumkreditzinserhöhung und ihre potenziellen Auswirkungen auf die Kreditkonditionen. Dabei beleuchten wir, warum es gerade jetzt ein günstiger Zeitpunkt sein könnte, einen Kredit in Erwägung zu ziehen.

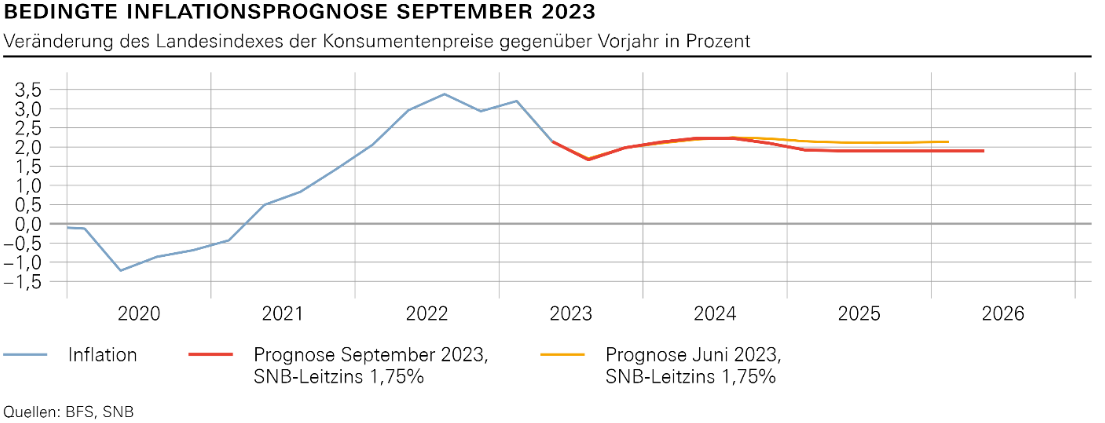

Bedingte Inflationsprognose September 2023

Gemäss der geldpolitischen Lagebeurteilung vom 21. September 2023 der Schweizerischen Nationalbank wird eine Zunahme der Inflationsrate per Ende dieses Jahres erwartet. Obwohl die Schweiz angesichts der globalen Lage bisher vergleichsweise wenig von der Inflation betroffen war, hat die Nationalbank den Leitzins kontinuierlich angehoben. Mit der erwarteten Zunahme der Inflation könnte der Leitzins als Reaktion ebenfalls erhöht werden.

Aussichten für den Höchstzinssatz von Konsumkrediten

Der Höchstzinssatz von Konsumkrediten ist in der Schweiz zum Schutz der Konsumenten gesetzlich geregelt. Gemäss Art. 1, Abs. 1 der Verordnung zum Konsumkreditgesetz (VKKG) gilt folgendes:

Der Höchstwert für den Zinssatz nach Art. 9, Abs. 2, Buchstabe b KKG (Höchstzinssatz) setzt sich zusammen aus:

- dem über 3 Monate aufgezinsten Saron (SAR3MC); und

- einem Zuschlag von 10 Prozentpunkten.

Der SARON (Swiss Average Rate Overnight) repräsentiert den durchschnittlichen Zinssatz, zu dem sich Geschäftsbanken in der Schweiz über Nacht Geld leihen. Er wird von der Börsenbetreiberin SIX anhand von tatsächlichen Transaktionen ermittelt. Diese Rate ist entscheidend, da sie als Referenz für zahlreiche Finanzprodukte auf dem Markt dient. Die Schweizerische Nationalbank nutzt ihre Geldpolitik, um sicherzustellen, dass der SARON möglichst nahe an ihrem eigenen Leitzins bleibt.[1] [2]

Gemäss der Verordnung zum Konsumkreditgesetz ist der Höchstzinssatz direkt an den SARON gebunden. Die Entwicklungen der Inflation und des Leitzinses haben somit einen verzögerten Einfluss auf den Höchstzinssatz.

Das Eidgenössische Justiz- und Polizeidepartement (EJPD), welches für die Anpassung des Höchstzinssatzes für Konsumkredite zuständig ist, hat bereits per 1. Mai eine Erhöhung festgelegt. Aktuell beträgt der Höchstzinssatz 11% für Barkredite und 13% für Überziehungskredite.

Quelle: SIX

Der aktuelle SAR3MC Zins liegt bei 1.71%. Gemäss VKKG könnte der Höchstzins für Konsumkredite von den bisherigen 11% auf 12% angehoben werden. Wie bereits dargelegt, ist eine Erhöhung des Leitzinses und somit des SARONs hinsichtlich der aktuellen Prognosen der SNB wahrscheinlich. Eine Erhöhung wäre bereits ab August möglich gewesen. Der Zeitpunkt einer Neuberechnung des Höchstzinssatzes liegt jedoch im Ermessen des Eidgenössischen Justiz- und Polizeidepartements (EJPD), muss jedoch mindestens einmal im Jahr erfolgen. Im Moment ist ein Rückgang der Inflation eher unwahrscheinlich, weshalb wir davon ausgehen, dass der Höchstzinssatz in den nächsten Monaten ansteigen wird.

Warum jetzt einen Kredit?

Banken richten sich bekannterweise nach dem Höchstzinssatz für Konsumkredite, um die maximalen Renditen erzielen zu können. Als Plattform für Kreditnehmer und Kreditgeber sind wir bei einer Erhöhung des Höchstzinssatzes ebenfalls gezwungen, unsere Zinssätze anzupassen, um für unsere Investoren konkurrenzfähig zu bleiben. Für Sie führen jedoch höhere Zinssätze zu schlechteren Kreditkonditionen. Aktuell bieten wir attraktive Privatkredite mit einem Zinssatz ab 5.9% an, weshalb im Moment ein guter Zeitpunkt wäre, einen Kredit aufzunehmen. Nach unseren Einschätzungen ist es unwahrscheinlich, dass nach einer Erhöhung des Höchstzinssatzes der Zinssatz in absehbarer Zeit wieder gesenkt wird.

Trotz der günstigen Bedingungen ist es wichtig, verantwortungsbewusst mit Krediten umzugehen. Gerne beraten wir Sie und versuchen mit Ihnen die beste Lösung für Ihre finanzielle Situation zu finden.

Sollten Sie weitere Fragen haben oder Unterstützung benötigen, stehen wir Ihnen gerne zur Verfügung. Sie können uns telefonisch unter 041 525 33 77 oder auch per E-Mail über info@crowd4cash.ch erreichen.

Wir würden uns freuen, wenn wir Sie auf Ihrem finanziellen Weg begleiten können.

[1] https://www.vermoegenszentrum.ch/wissen/saron-hypothek-das-sollten-sie-wissen#b

[2] https://www.snb.ch/de/iabout/monpol/id/qas_gp_ums_1#t4