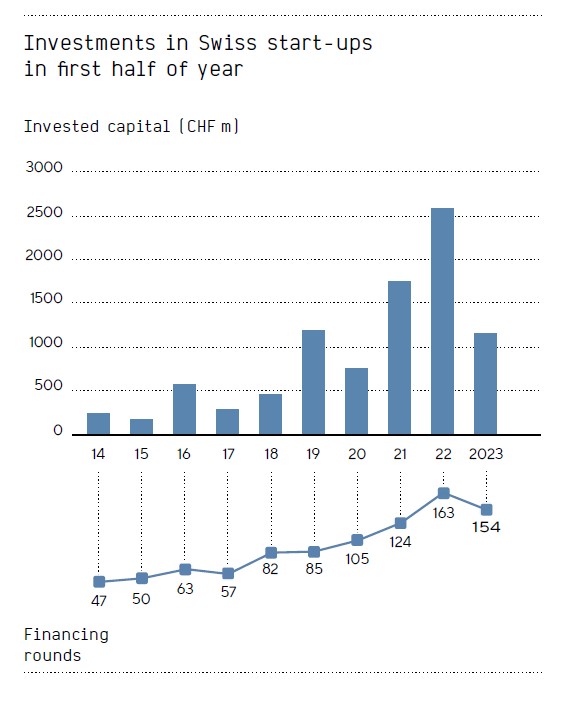

Seca und Startupticker.ch haben eine weitere Version des „Swiss Venture Capital Report 2023“ veröffentlicht, die den Status des Private-Equity-Marktes im ersten Quartal 2023 zeigt. In den ersten sechs Monaten des Jahres 2023 konnte sich die Schweizer Risikokapitalfinanzierung dem weltweiten rückläufigen Trend nicht entziehen. Es wurden rund CHF 1,2 Milliarden investiert, was einem Rückgang von 54 % im Vergleich zum entsprechenden Zeitraum im Jahr 2022 entspricht. Allerdings verzeichnete die Zahl der abgeschlossenen Finanzierungsrunden einen deutlichen Rückgang von 163 auf 154.

Investitionsübersicht

Schweizer Start-ups erwirtschafteten im ersten Halbjahr 2023 in 154 Finanzierungsrunden CHF 1.195,5 Millionen. Dies entspricht einem Rückgang des investierten Kapitals um 54 % im Vergleich zum Vorjahr. Die Zahl der Finanzierungsrunden ging jedoch nur um 5 % zurück. Es ist wichtig, die Stabilität der Finanzierungsrunden nicht zu überschätzen, da die relativ stabile Zahl wahrscheinlich darauf zurückzuführen ist, dass Start-ups ihre Runden nach Erhalt anfänglicher Zusagen von Investoren abschlossen, um das Risiko eines Verlusts zu vermeiden. Dies führte zu verschiedenen Arten von Finanzierungsrunden, wie z. B. Seed-Plus-Runden, Vorserien-A-Runden und ersten Abschlüssen von Serie-A-Runden, anstelle einer direkten Serie-A-Runde. Insgesamt gab es weniger Finanzierungsrunden als im Vorjahr und der Medianbetrag über alle Runden sank von 3 Mio. CHF auf 2,48 Mio. CHF. Darüber hinaus gingen auch die Top-Investitionen deutlich zurück. Im ersten Halbjahr 2022 flossen in die drei grössten Runden 1,133 Milliarden Franken ein, ähnlich dem Gesamtinvestitionsbetrag aller Finanzierungsrunden im Jahr 2023. Im Vergleich dazu flossen in die drei grössten Runden im Jahr 2023 lediglich 331 Millionen Franken ein.

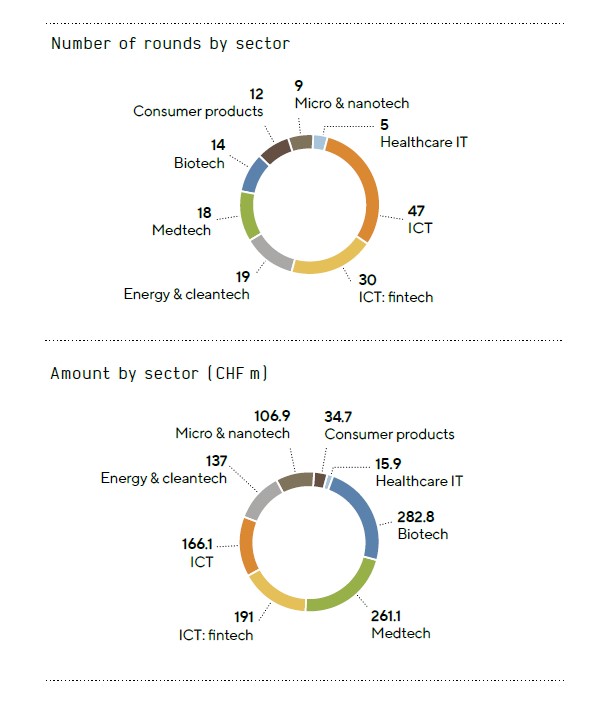

Sektorzuordnung

Der Rückgang der Gesamtinvestitionen in Schweizer Start-ups ist auf die IKT-Branche zurückzuführen. In den drei Schwerpunktbereichen IKT, Fintech und Gesundheits-IT ist ein deutlicher Rückgang der Zahlen zu verzeichnen. Im ersten Halbjahr 2022 konnten Start-ups in diesen Branchen knapp 1,4 Milliarden Franken anlocken, doch im gleichen Zeitraum 2023 sank der Betrag auf nur noch 373 Millionen Franken – ein Rückgang von über 73 %. Folglich erhielten Start-ups im Jahr 2022 nur noch rund ein Viertel ihrer erwirtschafteten Mittel. Die Biotech-Branche verzeichnete hingegen eine größere Stabilität mit einem leichten Anstieg der Investitionen im Vergleich zum Vorjahr (+3,5 %). Allerdings liegen die Investitionen in Biotech-Start-ups weiterhin deutlich unter den Rekordwerten der Jahre 2019 und 2021, wo sie in beiden Jahren deutlich über 400 Millionen Franken erwirtschafteten. Die Cleantech- und Medtech-Branche erlebten einzelne große Investitionen, wobei die Medtech-Branche in einer bedeutenden Finanzierungsrunde ein Allzeithoch erreichte. Im Cleantech-Sektor wurden hingegen deutlich weniger Investitionen getätigt als im ersten Halbjahr.

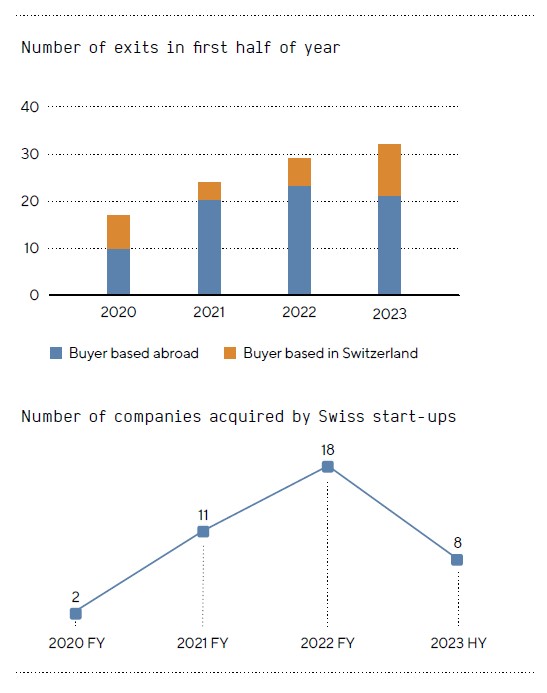

Exits/Verkäufe

Trotz der

herausfordernden Bedingungen auf dem Risikokapitalmarkt blieb die Zahl der Exits unverändert. Die Verkäufe an ausländische Unternehmen blieben stabil, während die Verkäufe an inländische Käufer im ersten Halbjahr 2023 sogar zunahmen. Dies könnte daran liegen, dass Gründer und Investoren eher bereit waren, vernünftige Angebote anzunehmen und Akquisitionen als Lösung für den anhaltenden Personalmangel sahen. Darüber hinaus haben Schweizer Start-ups in den letzten Jahren zunehmend andere Unternehmen übernommen, und dieser Trend setzt sich auch im Jahr 2023 fort. Mit acht Akquisitionen haben Start-ups bereits fast halb so viele Unternehmen übernommen wie im gesamten Jahr 2022. Diese Entwicklung deutet darauf hin, dass dies der Fall ist auf dem Weg, wieder das gleiche Niveau zu erreichen. Dies stellt eine ermutigende Entwicklung dar, da gut finanzierte Start-ups niedrigere Bewertungen und die schwierige Refinanzierungslandschaft anderer Unternehmen nutzen und es Schweizer Start-ups ermöglichen, schneller zu wachsen.

Ein paar Worte zur aktuellen Situation von Crowd4Cash

Der aktuelle Trend zeigt einmal mehr, dass striktes Kostenmanagement wichtig ist und bleibt. Crowd4Cash setzt bereits länger auf dieses Element bei der Planung und konnte sich bisher mit einem Minimum an externem Funding im Markt behaupten. Nebst einem bereits seit längerem positiven EBITDA konnte Crowd4Cash im Jahr 2022 sogar das erste Mal einen Gewinn ausweisen. Dies dank einem äusserst innovativen Geschäftsmodells, strikter Kostenkontrolle und einem stetigen Umsatzwachstum. Wir sehen Crowd4Cash daher als gut aufgestellt und bereit für die Zukunft.