Kreditantrag

Tragen Sie auf der Seite "Kredit beantragen", die Kreditsumme und die Laufzeit ein. Dadurch können Sie sofort sehen, wie hoch Ihre maximale monatliche Kreditrate und Ihre Gebühren sind.

Formulare rasch und übersichtlich online ausfüllen

Als Privatperson können Sie bei Crowd4Cash.ch Ihren Kreditantrag zu 100% Online einreichen. In ca. 15 Minuten (als KMU in ca. 30 Minuten) ohne viele Formulare mühsam per Hand auszufüllen und ohne wochenlange Wartefristen. Sie möchten Ihr Geld ja möglichst rasch! Mit den Fragen in den Formularen decken wir einerseits regulatorische Vorschriften ab (u.a. Geldwäschereigesetz, Konsumkreditgesetz) und erheben Daten für die Kreditprüfung.

Dokumente hochladen

Laden Sie die für die Kreditprüfung nötigen Dokumente bequem per Computer oder als Fotos von Ihrem Smartphone auf unsere Seite hoch. Die Dokumente werden durch uns geprüft und danach freigegeben. Erst wenn alle Dokumente erfolgreich freigegeben sind, können wir den Kredit auf unserer Seite aufschalten.

Prüfung Ihres Antrags

Das war schon alles! Nun werden wir Ihren Antrag samt den hochgeladenen Dokumenten gewissenhaft prüfen, um Ihre Kreditfähigkeit und Ihre Bonität zu bestätigen. Wird Ihr Antrag gutgeheissen, kommt bei der Auktion Ihr Kreditwunsch direkt auf unsere Webseite und ist für die Geldgeber anonymisiert ersichtlich.

Kreditentscheid innert maximal 24h (bei KMU 48h)

Als Privatperson erhalten Sie in maximal 24h Ihren Kreditentscheid. In den meisten Fällen werden Sie sogar in einigen wenigen Stunden von uns den Bescheid erhalten. Bei KMUs prüfen wir Ihren Antrag innerhalb von maximal 48h.

Gebotsphase - Es wird geboten

Sobald Ihr Wunschkredit auf der Webseite für die Anleger sichtbar ist, können für Ihr Projekt Gebote abgegeben werden. Dies für die von Ihnen festgelegte Angebotsfrist. Die Finanzierung ist abgeschlossen, wenn der Kredit vollständig gedeckt ist.

Sobald Ihre Kampagne abgeschlossen ist, werden Sie automatisch benachrichtigt. Selbstverständlich können Sie den Verlauf der Finanzierung für Ihren Wunschkredit auf der Webseite mitverfolgen.

Eine Kreditausfallversicherung, die beim Kreditantrag mit abgeschlossen werden kann, erhöhte Ihr Rating und gibt dem Kreditgeber mehr Sicherheit. Damit erhöhen Sie die Attraktivität Ihres Kreditprojektes, was zu mehr Geboten während eines kürzeren Zeitraums führen kann.

Abwicklung der Finanzierung / Auszahlung

Nach erfolgreichem Abschluss der Finanzierung wird Ihnen der finanzierte Kredit selbstverständlich direkt nach Ablauf der gesetzlichen Widerrufsfrist (14 Tage für Privatkredite und 7 Tage für KMU-Kredite) auf Ihr Konto überwiesen! Dafür müssen Sie und Ihre Anleger nach Auktionsende nur die von uns automatisch in ihrem Konto abgelegten Darlehensverträge unterschreiben - und es ist soweit!

Eigentliche Kreditphase

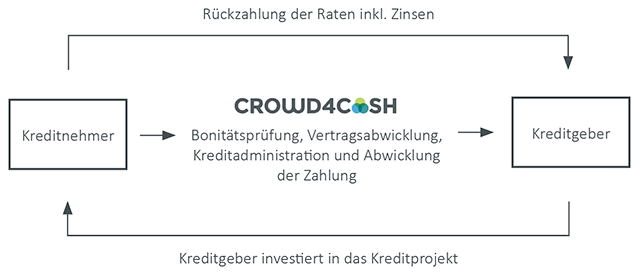

Auch die Ratenzahlungen regeln wir für Sie: Sie leisten nur eine Zahlung an Crowd4Cash den Rest machen wir. Wir informieren Sie ausführlich zu diesem Thema und leiten Ihre monatlichen Zahlungen direkt an Ihre Kreditgeber weiter. Und damit Sie den Überblick nicht verlieren, finden Sie in Ihrem persönlichen Bereich den aktuellen Stand der Ratenzahlungen und des verbleibenden Kreditrestbetrages.