Borrowers save money on Crowd4Cash as they can benefit from more attractive rates than traditional banks and credit card providers. In this sense, it is also important to us that our customers can save money on taxes. For this reason, we are hereby happy to give you instructions on how to correctly display the interest and the outstanding loan amount in your tax statement.

Legal sitatuation

Apart from the direct federal tax, the income taxes are regulated by cantonal law. Therefore, no general upper limit can be mentioned in relation to the allowable deductions. In principle, however, 100% of the interest on personal loans is deductible.

Regarding the direct federal tax, the tax decree SR 642.11 Art. 33 (1) regulates that interest on debt is covered by loans, e.g. can be deducted from a Personal loan up to an amount of CHF 50,000 in addition to income from movable and immovable property. This reduces the corresponding tax burden.

Which loans are deductible?

In the tax declaration debt interest can be claimed from different types of credit. The following loans are deductible:

• Private loans

• mortgage loans

• overdrafts

• Debit balances for credit cards

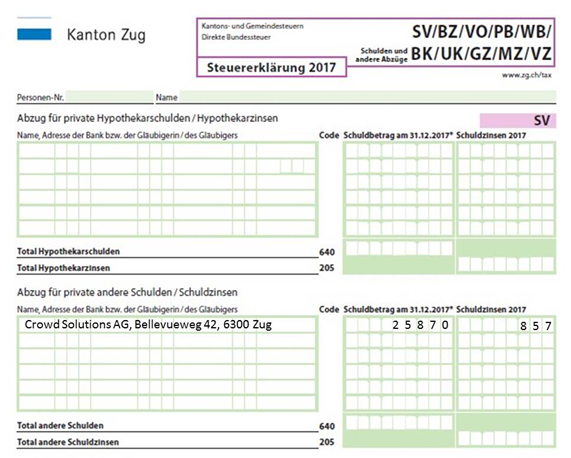

Leasing rates can not be taken into account for tax purposes. Leasing is not legally considered a loan, but a kind of rent purchase and is therefore not deductible (see also our blog Comparison car loan on leasing). Crowd4Cash provides you with an individual tax statement each year in your personal dashboard. In it you will find all the necessary information of the past year summarized in one document and thus can complete the tax statement without much effort.

Note: Tax statements are cantonally different, so depending on your canton of residence, forms and input may vary.

Your loan interest will now be deducted from your income and taken into account accordingly tax. The debt will be deducted from your assets. We look forward to assisting you with our clear tax statement in your tax declaration and helping you to reduce your tax burden.

For more answers to possible questions about the credit business at Crowd4Cash, we are happy to answer in our FAQ.