Wir werden immer wieder betreffend Absicherung für den Kreditnehmer und Sicherheit für den Anleger angefragt. Da die Ratenversicherung ein wichtiges Element im Crowdlending-Geschäft darstellt, nehmen wir dieses Thema gerne in unserem Blog auf.

Was sind Ratenversicherungen?

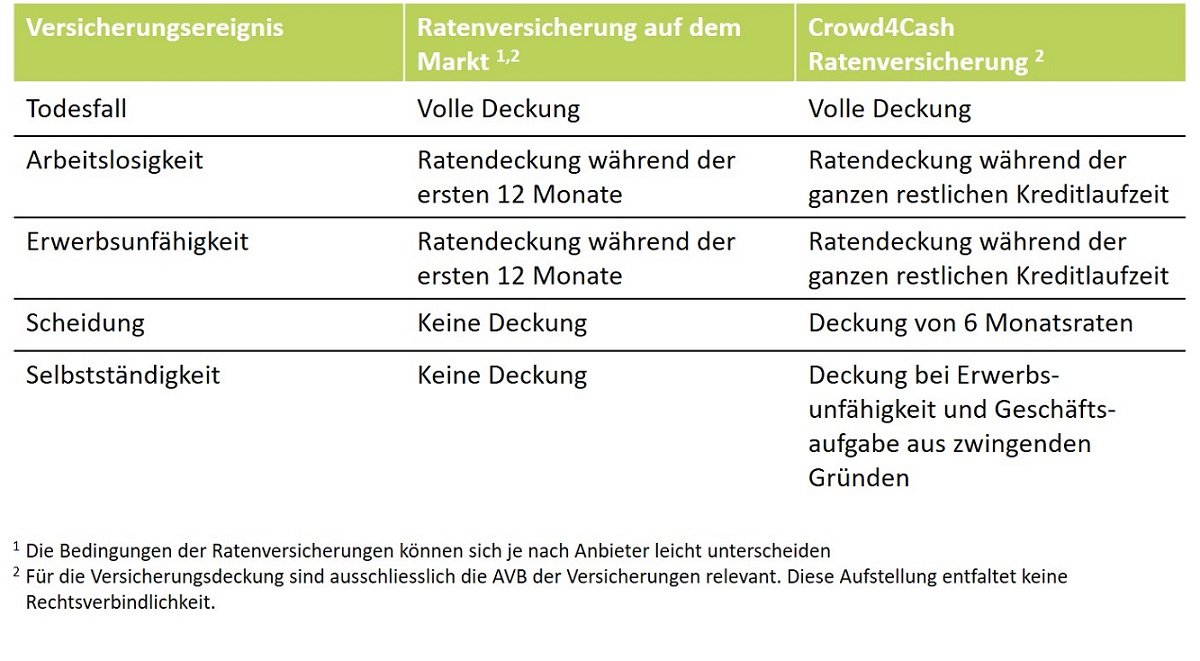

Die Ratenversicherung deckt die wichtigsten Risiken des privaten Kreditnehmers ab und bietet somit dem Kunden wie auch der Familie finanzielle Sicherheit im Schadenfall. Die Ratenversicherung bei Crowd4Cash deckt dabei Arbeitslosigkeit, Erwerbsunfähigkeit, Tod während der ganzen Laufzeit, bei Scheidung sechs Monatsraten ab. Dabei übernimmt die Versicherung die Ratenzahlungen anstelle des Kreditnehmers und reduziert damit dessen finanzielle Verpflichtungen. Der Kreditnehmer ist zwar Versicherungsnehmer, die Versicherung zahlt aber direkt an Crowd4Cash, welche dann die Zahlungen wie gewohnt an den Kreditgeber weiterleitet. Somit sinkt das Risiko für den Kreditgeber signifikant, da die wichtigsten Fälle eines Zahlungsausfalles weitgehend abgedeckt sind.Was bringen die Ratenversicherungen im Crowdlending?

Im Crowdlending sind die Ratenversicherung besonders wertvoll, da sie beiden involvierten Parteien mehr Sicherheit bietet. Der Kreditnehmer schützt sich und seine Angehörigen im Schadenfall vor den finanziellen Folgen der Kreditraten. Die Raten können im Falle von Arbeitslosigkeit und Erwerbsunfähigkeit, was das Einkommen drastisch schmälert, zu einer schweren finanziellen Bürde werden. Die Ratenversicherung übernimmt die Raten und bringt spürbare Entlastung. Für den Kreditgeber ergibt dies eine erhöhte Sicherheit, da die Raten im Schadenfall von einer finanzstarken Versicherung übernommen und bezahlt werden. Die Anleger sehen in der Investitionsübersicht direkt beim Kreditprojekt ob ein Versicherungsschutz besteht oder nicht.Was bietet Crowd4Cash an und was ist daran besonders?

Crowd4Cash bietet in der Schweiz die umfangreichste Ratenversicherung an. So sind in der Regel mit einer Wartefrist von drei Monaten 12 Monatsraten gedeckt im Falle von Arbeitslosigkeit oder Erwerbsunfähigkeit. Dies mag in vielen Fällen eine starke, kurzzeitige Entlastung bringen. Insbesondere bei längeren Laufzeiten kann diese Deckung aber ungenügend sein. Dies ist für alle Parteien sehr ärgerlich: So kann der Kreditnehmer seine Raten nicht mehr bezahlen und gerät unverschuldet in finanzielle Probleme. Der Kreditgeber erleidet allenfalls Verluste auf seiner Anlage.

Die Ratenversicherung von Crowd4Cash deckt hingegen die Risiken Arbeitslosigkeit und Erwerbsunfähigkeit nach der Wartefrist von drei Monaten während der ganzen Vertragslaufzeit ab. Zusätzlich werden im Scheidungsfall, ebenfalls ein häufiger Grund für finanzielle Probleme, sechs Monatsraten übernommen. Dies gibt beiden Parteien mehr Sicherheit. Die Kreditnehmer und -geber können in diesem Falle auch bei längeren Laufzeiten voll vom Versicherungsschutz profitieren. Mehr Informationen erhalten Sie hier. Selbstverständlich stehen wir wie immer auch persönlich für Fragen zur Verfügung.