A new edition of the "Marketplace Lending Report Switzerland" for the year 2023 has been published. As in previous reports, the current state and emerging trends in the Swiss marketplace lending market are comprehensively analyzed. The data comes from a cooperation between the Lucerne University of Applied Sciences and Arts and the Swiss Marketplace Lending Association, of which Crowd4Cash is also a member. In this blogpost we report on the outlook of the crowdlending market and its importance for Crowd4Cash.

Lending Marketplace Switzerland

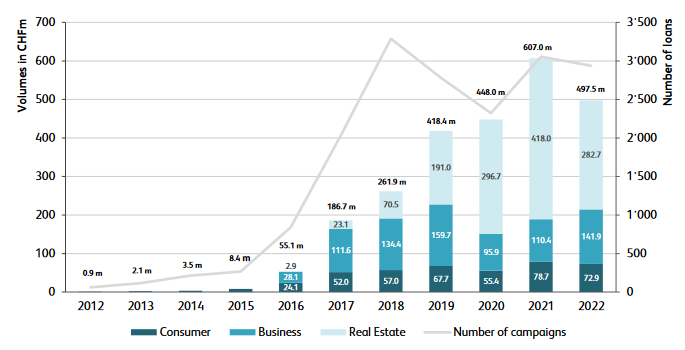

Source: Marketplace Lending Report Switzerland 2023

In 2022, the volume of crowdlending amounted to CHF 497.5 million. This represents a decrease of 18% compared to the previous year. However, it is important to emphasize that in 2021, real estate financing in particular increased strongly. This one-off increase has been put into perspective again in 2023. In comparison, SME financing actually increased last year. Private loans account for the smallest share. However, with an average amount of CHF 35,000 per loan, the amount has grown steadily since 2013 and is at the same level as conventional private loans, i.e. private loans from traditional providers.

For the calculation of average yields, payment defaults are included. Payment defaults are defined as late payments that are more than 120 days in the past or loans for which no payment is expected in the next 120 days.

As an example, personal loans and SME loans with a volume of CHF 74.4 million were disbursed in 2017. As of the end of 2018, a yield of 4.68% was already recorded. However, the average yields decreased to 4.03% as of the end of 2019 and to 3.37% as of the end of 2020. One reason for this decline in yields is the increased number of defaults, which may have been caused by the Covid pandemic. In the years 2021 and 2022, a decrease in payment defaults could already be observed again. At the end of 2022, an average return of 4.8% with an average default rate of 2% was recorded. As 97.2% of the loan volume issued in 2017 has already been repaid in the meantime, the average return achieved will only change marginally.

Innovationen

Crowdlending is in a perpetual state of flux and has spawned numerous innovations in the past. These innovations have been instrumental in the impressive expansion of this market since 2016. The various innovations are divided into three categories in this report: Increasing Efficiency, Sustainable Financing, and Increasing the Ecosystem.

Crowd4Cash's financing of rental vehicles is highlighted as an innovation here:

"Crowd4Cash has launched rental vehicle financing, expanding the business into a previously untapped field. It empowers companies across different sectors to unlock capital tied up in their rental businesses, including cars and e-mobility services. This can free up additional capital that companies can reinvest in their growth. It offers a user-friendly solution by simplifying the process.”

The introduction of rental vehicle financing through Crowd4Cash marks an important milestone for us. By tapping into this previously untapped area, Crowd4Cash opens up the possibility for numerous industries to mobilize tied-up capital from their rental businesses - be it in the area of conventional vehicles or in the emerging market of e-mobility. In the coming years, we forecast a significant increase in this area and are actively committed to continuously optimizing and developing our product.

In addition, the innovative Crowd4Cash Easy and Crowd4Cash Easy Business solutions were mentioned. They bridge the gap between online financing and offline sales channels. This enables us to offer our installment payment solution directly in customers' stores. The credit application process has been optimized so that the seller can handle it efficiently.

Here, too, we draw a positive balance. On average, we have seen a lower default rate among our Crowd4Cash Easy customers. By optimizing our credit processes, we have minimized the effort for our partner businesses. With the constant exchange with our partner businesses, we try to further improve this solution. Our customers thus benefit from a fast and uncomplicated installment payment option.

The study emphasizes that there is still considerable potential due to the large number of innovations. As one of the leading crowdlending platforms in Switzerland, we are proud that we have already been able to establish numerous pioneering innovations in this market. In this way, we are making a lasting contribution to the change and further development of the market. We will continue to develop our current innovations and actively improve our platform. In this way, we seek to exploit the potential of crowdlending in Switzerland and always offer our customers the best possible solution.