How is Switzerland financed?

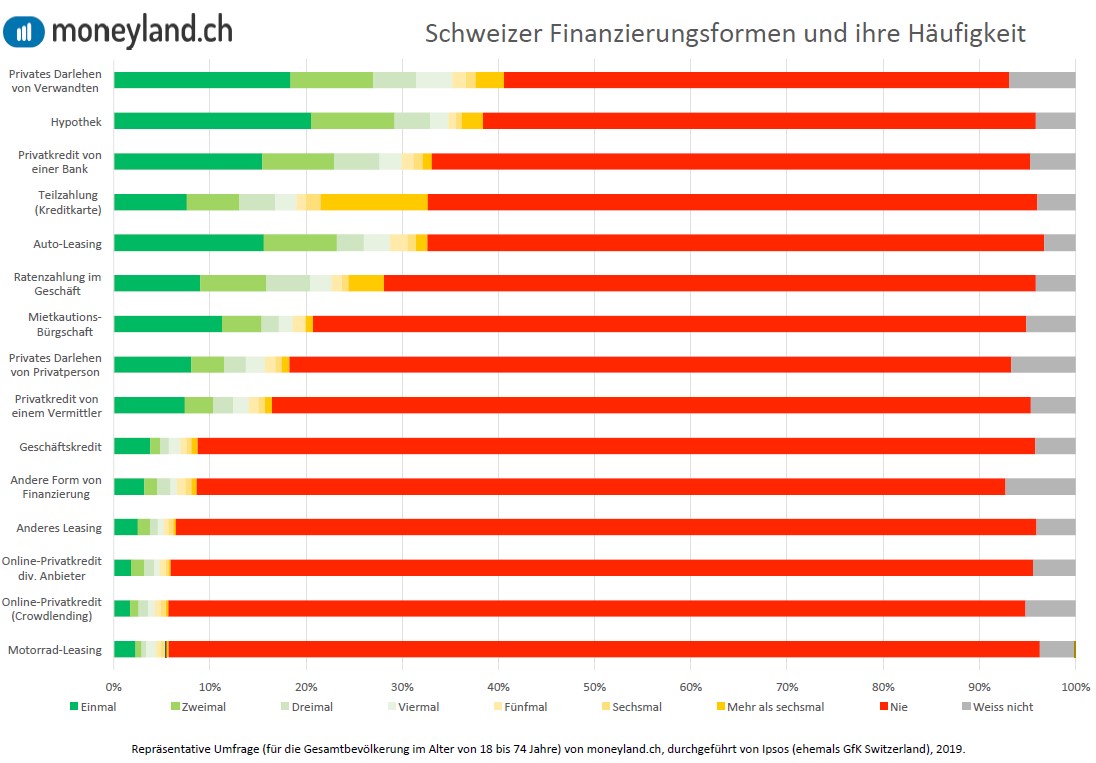

Despite the high average financial strength in Switzerland, almost 85% of the population has used at least once a personal loan, a loan, a leasing, a mortgage or other debt financing. Already 44% have once taken out a private loan, 37% a personal loan and 34% a leasing (car or other leasing). The financing of relatives and family members is the most common with 41%. This is followed by 33% car leasing, personal loan from a bank and part payments from a credit card.What is the money used for?

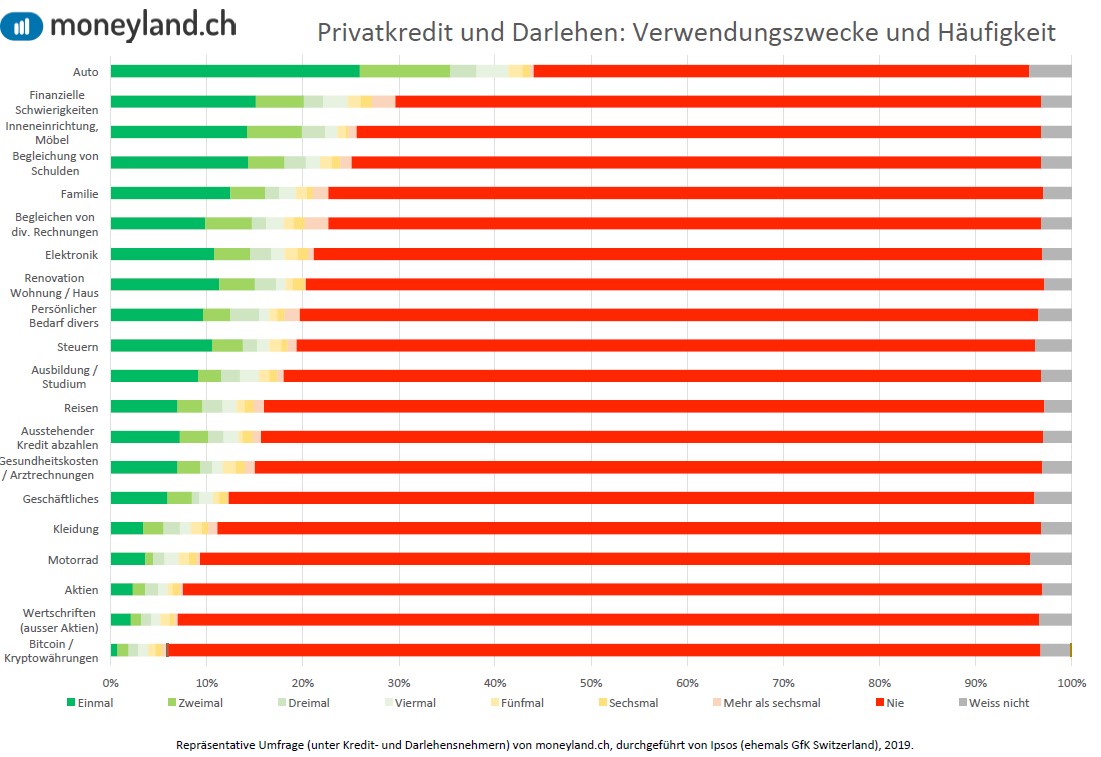

Unsurprisingly, at 44%, the car has been named the primary reason for financing needs. This is followed by 30% financial problems and furniture with 26%. This also roughly matches our perception, with Crowd4Cash also seeing a big trend towards debt restructuring. The interest differential between traditional credit providers and alternative providers in Crowdlending is still high, and debt rescheduling is worthwhile.Car leasing is widespread with a market share of 33%, although it is not always cheaper than a personal loan (read here). Of course we hope for a certain transfer to personal loans.

Where is crowdlending or online credit?

The crowdlending loan is still a niche existence. In the survey, 6% said they had taken a crowd lending loan before. However, there are big differences in age: 10% of 18- to 25-year-olds have already borrowed from Crowdlending platforms, compared with only 2% of those aged 50-74. By comparison, 18% of 18- to 25-year-olds have already taken out a classic personal loan from a bank, compared with 39% of those aged 50 to 74, more than twice as many.

This number of users surprises us a little, as we see the overall volume market share less high. We suspect that with Crowdlending loans in Switzerland as a new, still relatively unknown alternative, the funding amounts are lower than with traditional loans. This partly has something to do with the lack of funding capacity of the platforms. However, we expect that this will be a little easier, especially if the institutional investors discover this attractive investment for themselves. Already, we see a strong increase in credit requests on our platform, which is likely to intensify. In Anglo-Saxon countries, marketplace lending, also known as Crowdlending, already accounts for more than 80% of total lending volume. Therefore, we still see great potential here and are already looking forward to the next study.

See the detailled reports below (in german available only)