In the past, we were repeatedly asked by our clients what influence a potential interest rate trend could have on investments in the crowdlending environment and on us as a Swiss crowdlending provider. We take this as an opportunity to submit our own interest rate forecast and to point out the implications for the existing business. (Our interest rate forecast is our personal opinion, is in no way to be understood as an investment recommendation and is based on expert opinions.)

Interest expectation

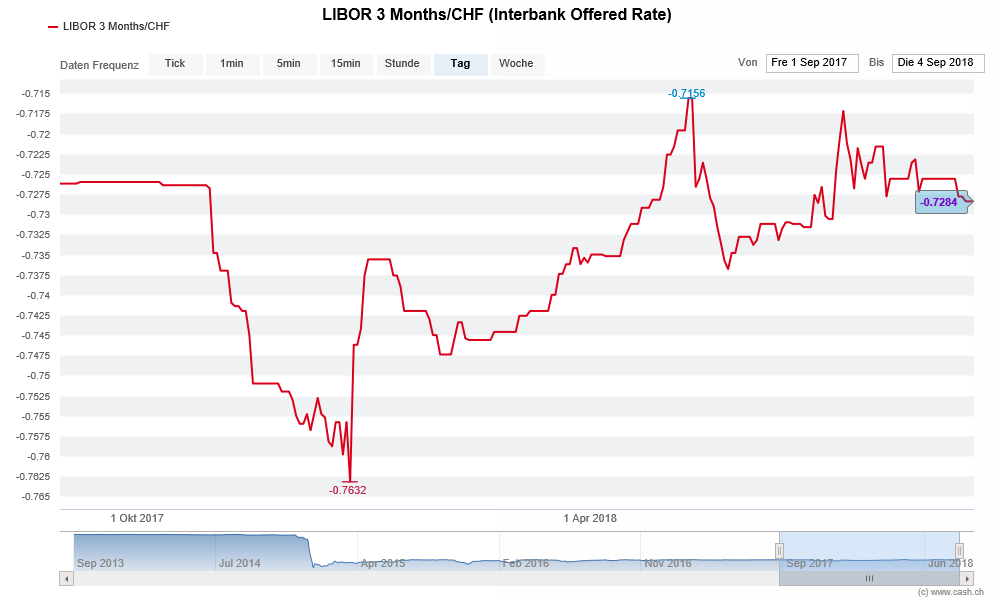

The Libor interest rate has been in negative territory for several years. In 2014, for example, the Swiss National Bank (SNB) reduced its key interest rate to -0.75% (see the CHF Libor in the chart below). Also at the meeting on 21.06.2018 no change in monetary policy was decided. (Source Cash.ch). We share the opinion of many economists that the Swiss National Bank can only take an interest-rate step when the European Central Bank (ECB) has raised its interest rates. If the SNB dares to go it alone, the Swiss franc will continue to strengthen and weaken the export economy accordingly. The ECB has already announced that it will consider raising interest rates at the earliest in the summer of 2019 (Source Cash.ch). Therefore, we do not expect CHF interest rates to increase in the positive range by the autumn of 2019. Usually, interest rates will normalize and the time on the investment side will take much longer. In anticipation of this increase in interest rates, investing in a broadly diversified crowdlending / P2P lending portfolio is an ideal addition to the investment portfolio.

Source: Cash.ch

Maximum interest rates in consumer credit

As of June 1, 2016, the Federal Council has set the maximum interest rates in the consumer credit sector based on its competence in the consumer credit law. For consumer credit, the Libor serves as the reference interest rate and is calculated with an interest premium of 10%. This supplement serves to cover the costs and also includes a corresponding margin. The cut-off date for determining interest is August 31st. For the year 2019, 10% remains the maximum interest rate on consumer loans (personal loans). The following table shows the current applicable rates with corresponding Libor:

Dreimonats-Libor am 31

| Three-month Libor on August 31 of the previous year | Maximum interest rate from 1 January of the following year |

| negative Libor | 10% |

| 0% - 0.49% | 10% |

| 0.5% -1.49% | 11% |

| 1.5% - 2.49% | 12% |

| 2.5% - 3.49% | 13% |

| 3.5% - 4.49% | 14% |

| 4.5% - 5.49% | 15% |

| above 5.5 % | is determined on an individual basis |

With our expectation of the delayed normalization of the interest rate environment, we expect at the earliest from 2021 onwards an increase in the maximum interest rate in the consumer credit sector.

Impact on existing loan agreements

Existing loan agreements remain unaffected by a possible increase in interest rates. The existing lending rate as well as the monthly installments remain unchanged until the end of the term.

Impact on a crowdlending portfolio

Since the existing interest rates and installments are fixed, the default risk does not change in the event of a potential increase in interest rates. On the other hand, due to the regular repayments (installments include interest and capital), reinvestment in new loan projects can even benefit investors from future interest rate increases.

Impact on Crowd4Cash

Despite possible rising interest rates, we do not expect any negative impact on credit demand or on our business model. We

at Crowd4Cash will continue to adhere to our maxim in the event of

changing interest rates and provide our investors and borrowers with an

attractive interest rate environment. Our customers profit from digital and lean business processes. We are happy to pass on this cost advantage to our borrowers and investors through unrivaled interest rates. Register now.